| Bond |

| A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are used by companies, municipalities, states and sovereign governments to raise money and finance a variety of projects and activities. Owners of bonds are debtholders, or creditors, of the issuer.

Example: You give $10,000 for a bond to a company… they pay you 5% interest …. but they invest in project earning 10% … so everyone wins. Much better then 1-2% in the bank =( |

Tag: learning

We all keep getting emails from other realtors, investors, Ugly Homes, Wholesalers…. etc… “Hey … just checking in to see if you have any fixer uppers or ugly homes that are off market” or my fav… “You have any off market deals?”…

Why do you think they want them?

They want them at a very good deal, not any where near market value and they are willing to pay you your commission for it…. wow so $3000-6000 woohoooo! Time to Retire! You will spend that money in a heartbeat… hell you can spend that in a weekend! lol….

So here’s what i’m pitching – (yes my pitch)

Let’s team up! 50/50 – You find the deals, I get the funding, we get it fixed then sale it for a big profit… Not $3000-6000 but most likely $30,000-90,000! My biggest flip was $187,000 profit, another for $310,000. So i’m not playing and anyone wants to come see my Closing Statements… come on over… I have the proof and closings in HAR. So you are dealing with the main person, what i’m doing is looking to partner up with Go-Getters and people who want better in there life, BUT ARE WILLING TO PUT IN THE WORK.

Interested?

Let’s make it easy….

- Find a deal of a house (look for sellers who are SUPERRRRRR MOTIVATED)

- Looking for something that is 50-60% of market value

- another 15% or less for repairs

- then we sale for the 25%+ profit

- then we split profits

- easy as that….

Who is Allen Jimenez at USPrimeLending.com

- Nearly 15 years in real estate

- Real estate broker / Mentor

- Commercial Mortgage Broker for about 10 years now… (time flys)

- Wholesale Trainer / Mentor

- Construction Company Owner

- Built homes from scratch

- Designed homes from scratch

- Thorough understanding of the City Permit Process

- Re-Model Homes

- My first rehab was a 70k condo on Westheimer about 14 years ago

- My current rehab is http://www.1AcreHouse.com

- My previous rehab just completed and sold is 827 w. 19th

- My previous inv was 825 w 19th –

- the list goes on and on

IF YOUR FULL OF EXCUSES DON’T CONTACT ME

IF YOU THINK YOU CAN’T DO IT THEN DON’T CONTACT ME

IF YOU’RE NOT WILLING TO DO HARD WORK DON’T WASTE MY TIME…

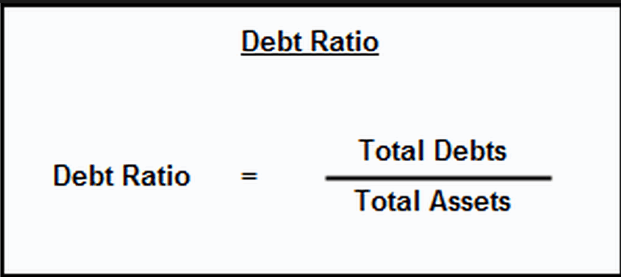

Basically it is a ratio of debt vs assets. Many lenders view this ratio as a way to determine the company’s / persons financial strength. A lender will view a person with small debt vs large assets much better then a person with a lot of debt and very little assets. It is pretty much common sense, for example;

You have 10,000 debt but have 100,000 in assets thus you have a 1/10th Debt Ratio (10%). A lender has a breaking point such as .43 in FHA / Fannie Mae, once reached you are disqualified from the loan. So keep debts down as it can disqualify you for an investment opportunity.

You must be logged in to post a comment.