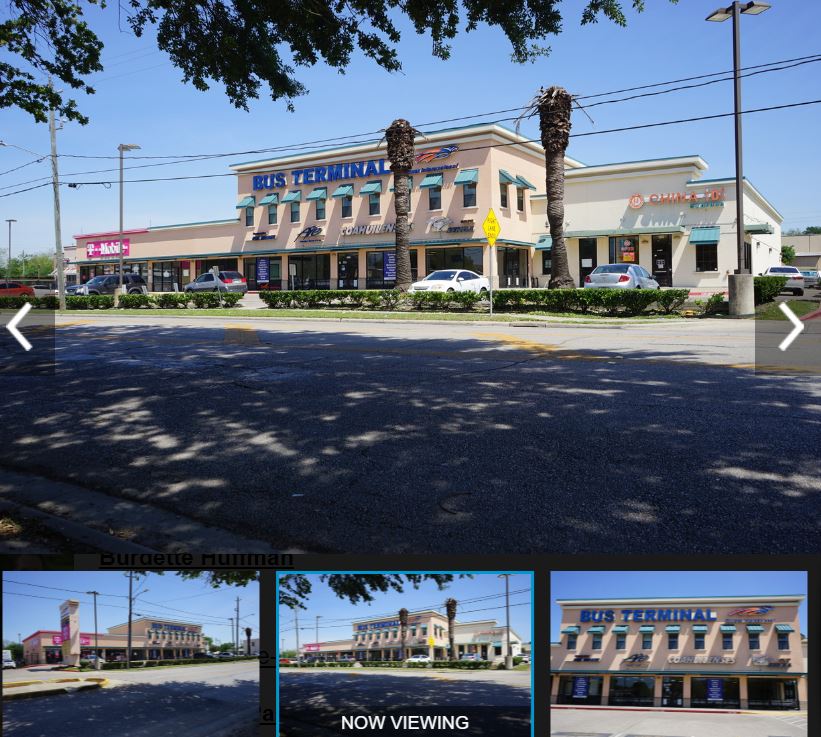

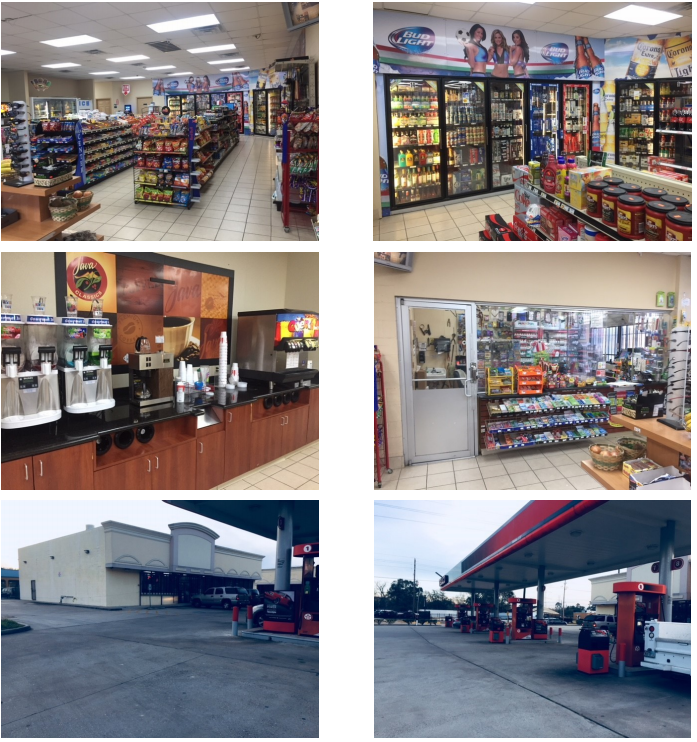

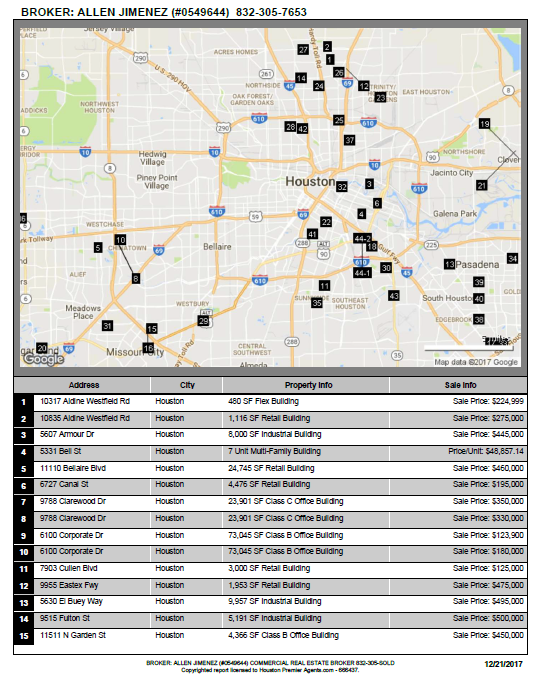

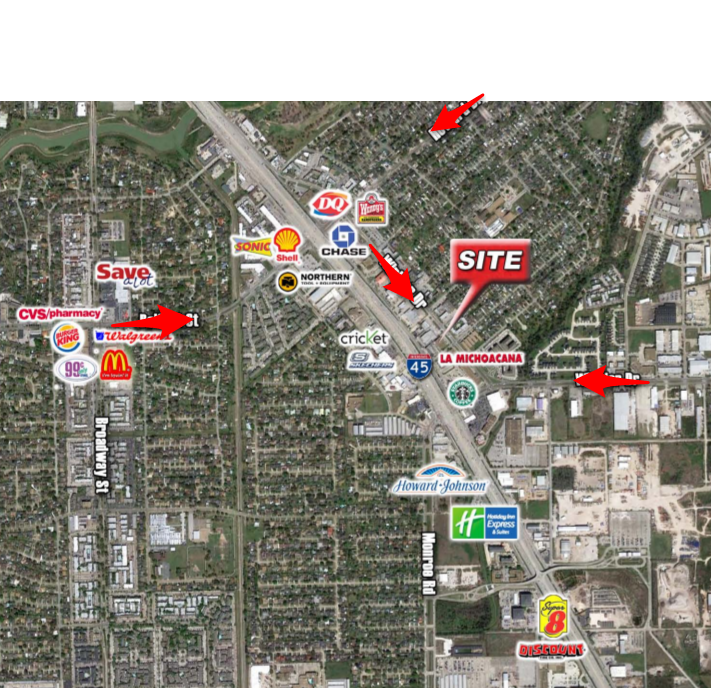

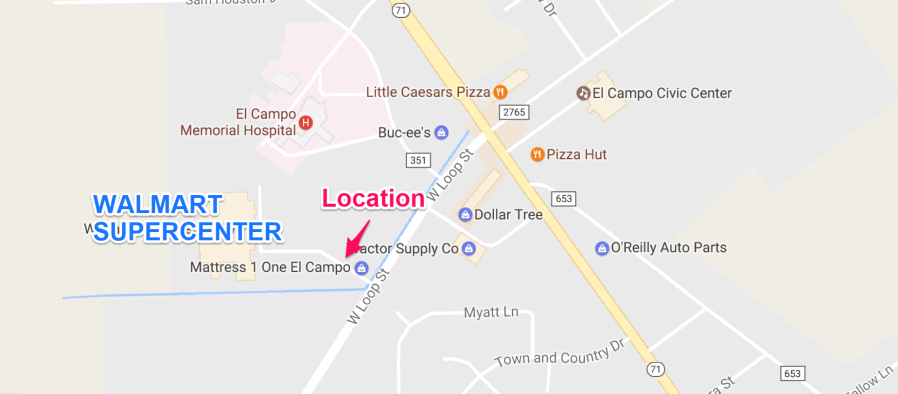

This Houston Shopping Center is a 13,544 square foot retail center situated on a 29,751 square foot parcel at the intersection of 2 Main Streets in Houston, Texas, and has a 9% Cap at $75,000 Net Operating Income.

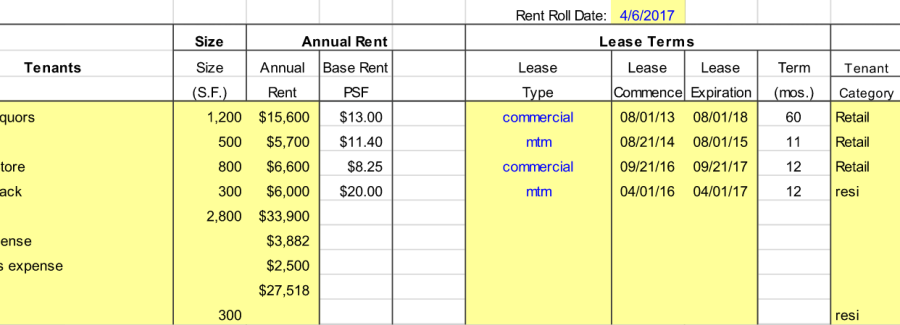

The center is 100% occupied by four local area tenants signed to triple net (NNN) leases, reimbursing the owner for operating expenses. Rents are all under market, allowing for future upside.

The property is highlighted by its strong retail fundamentals, such the center’s small, easy to lease spaces, shallow bay depth, reinforced concrete construction, two egress/ingress points, and excellent visibility

NEED MORE INFORMATION: SIGN commission protection agreement

Net Operating Income: $75,000 Annually

Type 2 Star Retail (Strip Center)

GLA 17,700 SF

Stories 1

Typical Floor 17,700 SF

Docks 2 ext

Construction Reinforced Concrete

Year Built 1983

Tenancy Multi

Owner Occup No

Elevators 0

Parking 18 free Surface Spaces are available; Ratio of 1.03/1,000 SF

Taxes$1.12/SF (2016)

Opex$1.15/SF (2011)

Land Acres 0.68 AC

Bldg FAR 0.59

Land SF 29,751 SF

Dimensions 165′ x 180′

|

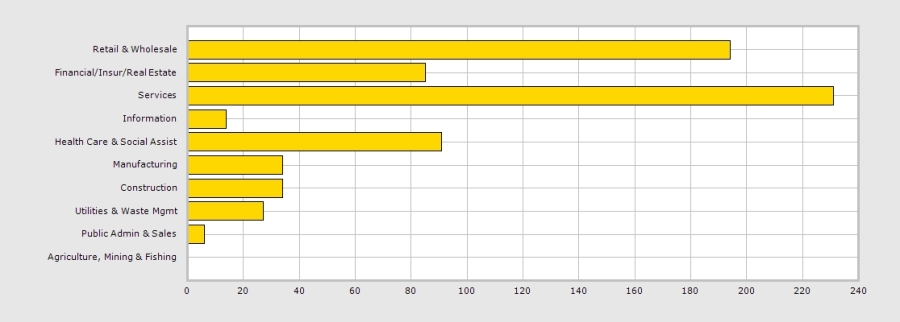

1 Mi |

3 Mi |

|

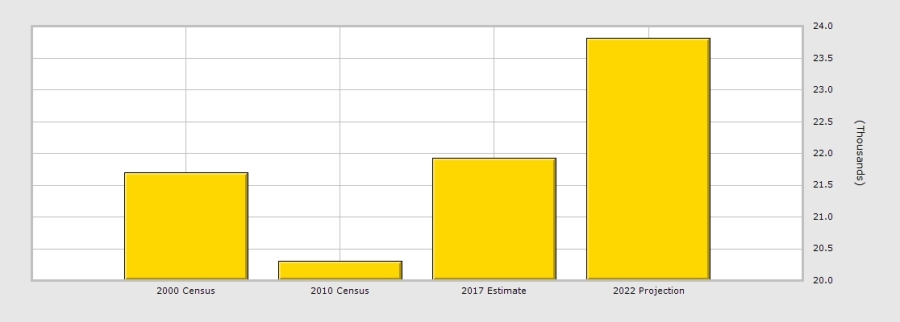

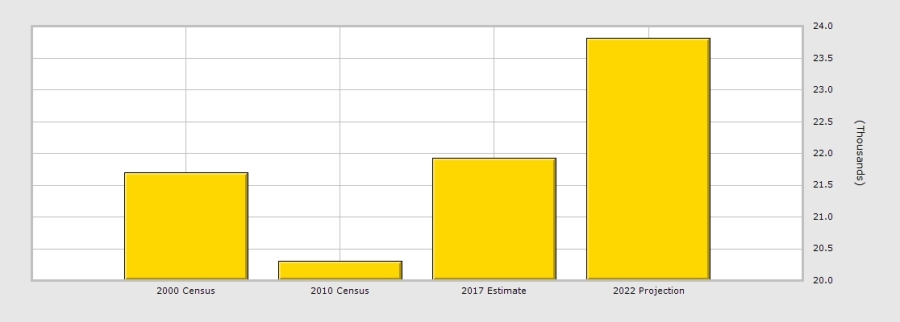

Population

|

21,928

|

144,617

|

|

Households

|

7,044

|

43,340

|

|

Average Age

|

32.90

|

32.70

|

|

Median HH Income

|

$35,650

|

$39,552

|

|

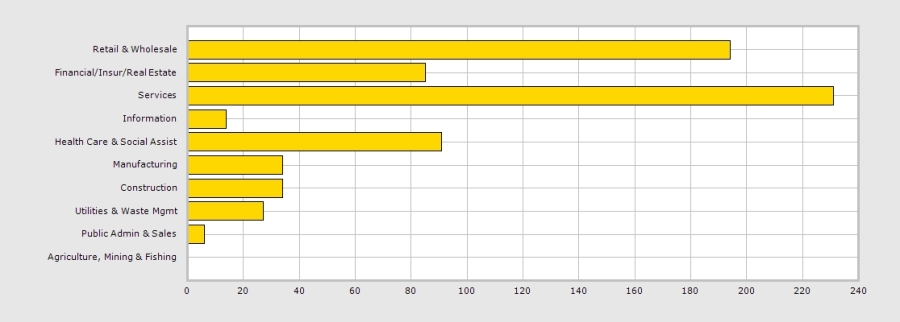

Daytime Employees

|

6,212

|

44,620

|

|

Population Growth ’17-’22

|

|

|

|

Household Growth ’17-’22

|

|

|

You must be logged in to post a comment.